SOCIAL INTERMEDIATION OF SHARIA BANKING FROM THE ISLAMIC LAW PERSPECTIVE: A Case Study at Bank Negara Indonesia (BNI) Syari’ah

Abstract

This research focuses on the dynamics of social intermediation implemented by BNI Syari’ah in Kendari City, South Sulawesi, Indonesia based on the Islamic law perspective and its impact on social life. In developing and realizing the social intermediation function of Islamic banks that arise from administrative-structural and cultural dimensions, the interpretation and meaning of a conceptual perspective are present. Therefore, this research applies a qualitative approach with a case study type through a one-site design. Data collection is done through in-depth interviews, participatory observation, and documentation study. The data were analyzed with the principle of on-going analysis using Miles and Huberman's analysis method. The research found that social intermediation implemented by BSK (BNI Syari’ah Kendari) really determines the potential and mentality of the poor society. This social intermediation is in the form of institutions such as the bayt al-mâl. This way, the poor can receive zakât, infâq, alms, grants, and other social funds. Furthermore, the social intermediation even has a positive impact on the community, because it integratively puts forward the concept of maslahah (according to the principles of maqâsid al-sharî‘ah).

Keywords

Full Text:

PDFReferences

Agustina, Dian. 2019. “The Efficiency of Indonesian Islamic Rural Banks: A Stochastic Frontier Analysis,.” International Journal of Islamic Economics and Finance 1(2): 229–48. DOI: https://doi.org/10.18196/ijief.1212.

Ahmad, Mustaq. 2001. Etika Bisnis Dalam Islam. Jakarta: Pustaka al-Kautsar.

Antonio, Muhammad Syafi’i. 2002. “Bisnis Dan Perbankan Dalam Perspektif Hukum Islam.” al-Mawardi 7(1): 17–25.

Antonio, Muhammad Syafii and Hilman F. Nugraha. 2013. “Peran Intermediasi Sosial Perbankan Syari’ah Bagi Masyarakat Miskin.” Tsaqafah: Jurnal Peradaban Islam 9(1): 123–48. DOI: http://dx.doi.org/10.21111/tsaqafah.v9i1.43.

Aprianto, Naerul Edwin Kiky. 2017. “Konsep Harta Dalam Tinjauan Maqashid Syari’ah.” Journal of Islamic Economic Lariba 3(2): 65–74. DOI: 10.20885/jielariba.vol3.iss2.art2.

Arafah, Muh. 2019. “Sistem Keuangan Islam: Sebuah Telaah Teoritis.” al-Kharaj: Journal of Islamic Economic and Business 1(1): 56–66. DOI:https://doi.org/10.24256/kharaj.v1i1.801.

Azizah, Sheilavy et al. 2020. “Analisis Maqashid Syari’ah Tentang Menjaga Harta Terhadap Penangguhan Penyerahan Jaminan Logam Mulia Kolektif.” In Prosiding Keuangan & Perbankan Syari’ah, 53–56.

Bongomin, George Okello Candiya. 2018. “Financial Intermediation and Financial Inclusion of the Poor: Testing the Moderating Role of Institutional Pillars in Rural Uganda.” International Journal of Ethics and Systems 34(2): 146–65. DOI:https://doi.org/10.1108/IJOES-07-2017-0101.

Endaryanto, Teguh. 2018. “Analisis Kinerja Ekonomi Dan Keuangan Daerah Di Provinsi Lampung.” Sosiohumaniora: Journal of Social Sciences and Humanities 20(1): 95–102. DOI: https://doi.org/10.24198/sosiohumaniora.v20i1.9501.

Fauziah, Nur Dinah. 2019. Bank Dan Lembaga Keuangan Syari’ah. Malang: Literasi Nusantara.

Ibrahim, Mansor H., and Siong Hook Law. 2019. “Financial Intermediation Costs in a Dual Banking System: The Role of Islamic Banking.” Bulletin of Monetary Economics and Banking 22(4): 531–52. DOI: https://doi.org/10.21098/bemp.v22i4.1236.

Imama, Lely Shofa. 2008. “Ekonomi Islam: Rasional Dan Relevan.” La Riba: Jurnal Ekonomi Islam 2(2): 309–17.

Iqbal, Munawar. 2013. “Islamic Finance: An Attractive New Way of Financial Intermediation.” International Journal of Banking and Finance (IJBF) 10(2): 1–24.

Iqbal, Zamir, and Abbas Mirakhor. 2008. Pengantar Keuangan Islam: Teori Dan Praktik. Jakarta: Kencana.

Jayadi, Hendri, and Huala Adolf. 2018. “Fungsi Lembaga Penjamin Simpanan Dalam Hukum Perbankan Indonesia.” Jurnal Komunikasi Hukum 4(2): 66–88. DOI: http://dx.doi.org/10.23887/jkh.v4i2.15444.

Kamukama, Nixon, and Bazinzi Natamba. 2013. “Social Intermediation and Financial Services Access in Uganda’s Microfinance Industry.” African Journal of Economic and Management Studies 4(3): 358–71. DOI: https://doi.org/10.1108/AJEMS-10-2011-0077.

Khan, Feisal. 2010. “How ‘Islamic’ Is Islamic Banking?” Journal of Economic Behavior & Organization 76(3): 805–20. DOI: https://doi.org/10.1016/j.jebo.2010.09.015.

Kolistiawan, Budi. 2017. “Tantangan Lembaga Keuangan Syariah Dalam Menghadapi Masyarakat Ekonomi ASEAN.” Muqtasid: Jurnal Ekonomi dan Perbankan Syariah 12(1): 109–18. DOI: https://doi.org/10.18326/muqtasid.v8i1.54-64.

Lakhdar, Rabhi and Benyekken Abdelmadjid. 2017. “Protection of Bank Deposits in Islamic Jurisprudence and Algerian Legislation.” Ulul Albab: Jurnal Studi Islam 18(2): 184–204. DOI: https://doi.org/10.18860/ua.v18i2.4297.

Mutakin, Ali. 2017. “Teori Maqashid Al-Syari’ah Dan Hubungannya Dengan Metode Istinbath Hukum.” Kanun Jurnal Ilmu Hukum 19(3): 547–70.

Nofrianto, and Suardi. 2015. “Bank Syari’ah Dan Pemberdayaan Coorporate Social Responsibility: Peran Dan Fungsi Bank Syari’ah Perspektif Filosofi Sosio-Ekonomi,.” Akademika:Jurnal Pemikiran Islam 20(2): 261-276. https://e-journal.metrouniv.ac.id/index.php/akademika/article/view/446.

Nuh, Muhammad. 2020. Ekonomi Dan Keuangan Syari’ah: Isu-Isu Kontemporer. Jakarta: PT. Elex Media Komputindo.

Purwanto. 2019. “Meningkatkan Profitabilitas Dengan Menerapkan Islamic Corporate Identity: Studi Pada Bank Umum Syari’ah Di Indonesia Tahun 2014-2017.” Iqtishadia: Jurnal Ekonomi dan Perbankan Syari’ah 6(2): 131–40. DOI: https://doi.org/10.19105/iqtishadia.v6i2.2350.

Putera, Andika Persada. 2019. Hukum Perbankan: Analisis Mengenai Prinsip, Produk, Resiko Dan Manajemen Resiko Dalam Perbankan. Surabaya: Scopindo Media Pratama.

Putritama, Afrida. n.d. “Penerapan Etika Bisnis Islam Dalam Industri Perbankan Syariah.” Nominal, Barometer Riset Akuntansi dan Manajemen 7(1): 1–20. DOI: https://doi.org/10.21831/nominal.v7i1.19356.

Ryandono, Muhamad Nafik Hadi, and Rofiul Wahyudi. 2018. Manajemen Bank Islam: Pendekatan Syari’ah Dan Praktek. Yogyakarta: UAD Press.

Santoso, Moh. Herman Eko, and Mohamad Soleh Nurzaman. 2020. “Asesmen Kontribusi Keuangan Syari’ah Terhadap Pertumbuhan Ekonomi Di Indonesia.” Al-Mashrafiyah: Jurnal Ekonomi, Keuangan Dan Perbakan Syari’ah 4(1): 1–15. DOI: https://doi.org/10.24252/al-mashrafiyah.v4i1.12304.

Siringoringo, Renniwaty. 2012. “Karakteristik Dan Fungsi Intermediasi Perbankan Di Indonesia.” Bulletin of Monetary Economics and Banking 15(1): 61–83. DOI: https://doi.org/10.21098/bemp.v15i1.57.

Supriyatni, Renny. 2012. “Tanggung Jawab Bank Syari’ah Dalam Penerapan Prinsip Kehati-Hatian Dan Good Corporate Governance.” Ahkam: Jurnal Ilmu Syari’ah 12(1): 109–18. DOI: http://dx.doi.org/10.15408/ajis.v12i1.985.

Susyanti, Jeni. 2016. Pengelolaan Lembaga Keuangan Syari’ah. Malang: Empat Dua.

Syafi’i, Antonio. 2011. Bank Syariah: Dari Teori Ke Praktek. Jakarta: Tazkia Cendikia.

Wairimu, ZabronChege, and Shadrack Mwenda Mwilaria. 2017a. “Microfinance Institution’ Social Ntermediation and Micro and Small Enterprises Survival in Thika Town, Kenya.” Asia Pacific Journal of Multidisciplinary Research 5(2): 87–93.

Wairimu, ZabronChege, and Shadrack Mwenda Mwilaria. 2017b. “Microfinance Institutions’ Social Intermediation and Micro and Small Enterprises Survival in Thika Town, Kenya.” Asia Pacific Journal of Multidisciplinary Research 5(2): 87–93.

Wardhono, Adthitya. 2018. Inklusi Keuangan Dalam Persimpangan Kohesi Sosial Dan Pembangunan Ekonomi Berkelanjutan. Jember: Pustaka Abadi.

Wediawati, Base, and Rike Setiawati. 2016. “Spiritual Intermediation in Islamic Microfinance: Evidence from Ndonesia.” Proceedings of the International Conference, Integrated Microfinance Management for Sustainable Community Development: 155–61.

Yunita, Widia, and Andri Brawijaya. 2019. “Perbandingan Penerapan Kode Etik Syari’ah Di Lembaga Keuangan Syari’ah: Studi Pada Bank BNI Syari’ah Dan BTN Syari’ah.” Nisbah: Jurnal Perbankan Syari’ah 5(1): 30–44. DOI: https://doi.org/10.30997/jn.v5i1.

DOI: https://doi.org/10.18860/ua.v23i1.15491

Refbacks

- There are currently no refbacks.

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

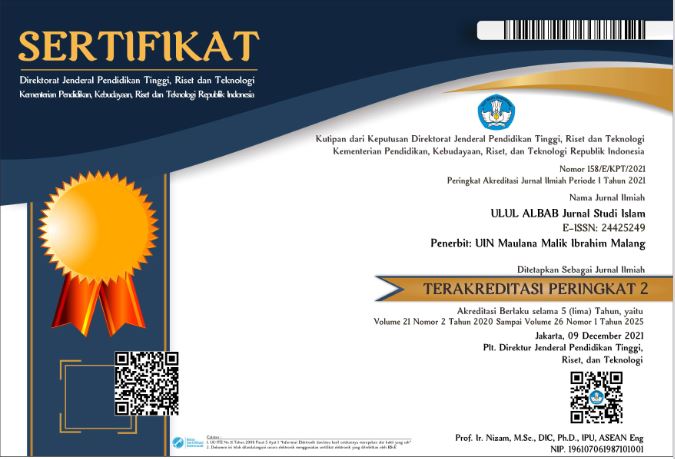

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249