MANAJEMEN INKLUSIF DENGAN PRINSIP MAQASHID AL SYARI‘AH DALAM PENGHITUNGAN ZAKAT DAN PAJAK

Abstract

This article describes the condition of applying zakah and tax calculation management in Indonesia. The enactment of tax regulation is to get the government to obtain the maximum national income to be utilized for social welfare.In fact, zakah as a potential economic instrument inincreasing the national income, has been paid less attention by the government rather than the issue of tax payment. Although the government has issued regulations on the integration of zakah and tax calculations, some weaknesses found especially related to the implementation of the zakah and tax calculation. This paper concludes that the governement is expected to implement and inclusive management based on principle of maqashid al syari‘ah in determining the amount of zakah and tax for better collection and distribution of zakah and tax. The principle of maqashid al syari‘ah means that Islamic law has a purpose to prosper the people. Similarly, zakat together with taxes essentially aims at alleviating poverty and improving the welfare of Muslims.

Keywords

Full Text:

PDFReferences

Al Sid, Muhammad Ata . 1991. General Objectives of Islamic Shari’ah: The Reality of the Divine. Mozer Kahf (ed.),Lesson In Islamic Economics. Seminar Proceeding. IDB-IRTI. Jeddah KSA.

Al Syathibi, Abu Ishaq. 2004. Al Muwafaqat fi Ushul al Syari‘ah. Beirut: Dar Kutub al ‘Ilmiyah.

Arikunto, Suharsimi & Yuliana, Lia. 2009. Manajemen Pendidikan.Yogyakarta: UNY.

Gusfahmi. 2015. “Pajak Menurut Syari’ah” diakses dari http://www.pajak.go.id/content/article/pajak-menurut-syariah. tanggal 14 Agustus 2017.

Hasan, Sudirman. 2014. Government Policy on Zakat and Tax in Indonesia in the View of Maqashid al-Shariah. The Development of Islamic Studies in Indonesia and Malaysia, International Seminar Proceeding April15. Malang: Pascasarjana Universitas Islam Negeri Maulana Malik Ibrahim: 177-184.

Himpunan Peraturan Perundang-Undangan tentang Kompilasi Hukum Islam.2007. Fokus Media: Bandung.

Iska, Syukri. 2012. Sistem Perbankan Syariah di Indonesia dalam Prespektif Fikih Ekonomi. Yogyakarta: Fajar Media Press.

Kelsen, Hans. 2012. Pengantar Teori Hukum, terj. Siwi Purwadari. Bandung: Nusa Media.

Kholilah. 2011. Integrasi Zakat Profesi dan Pajak Penghasilan dalam Perekonomian Sebagai Solusi Pengentasan Kemiskinan di Indonesia. Muqaddimah: Jurnal Ekonomi Islam. Vol. 2, No. 1: 1–19.

Musnandar, Aries. 2013. Spektrum Ekonomi Indonesia. Malang: Genius Media.

Musnandar, Aries. 2014. Indonesia: A Country of Challenge. Malang: UB Press.

Musnandar, Aries. 2017. Zakat dan Pemerataan Kesejahteraan” diakses dari https://indonesiana.tempo.co/read/115260/2017/08/14/raries.m1/zakat-dan-pemerataan-kesejahteraan. tanggal 14 Agustus 2017.

Shahir Bin Makhtar, A. dan & Shofian, Ahmad. 2014. Aplikasi Prinsip Maqasid Al-Syariah dalam Pengurusan Zakat di Malaysia. The Development of Islamic Studies in Indonesia and Malaysia, International Seminar Proceeding April 15. Malang: Pascasarjana Universitas Islam Negeri Maulana Malik Ibrahim: 13-22.

Subarkah, Ibnu. 2009. Hakim Pengemban Amanah Pemilu. Jurnal Konstitusi. Vol. 2, No. 1: 76-90.

Undang-Undang No. 38 Tahun 1999 tentang Pengelolaan Zakat.

Undang-Undang No.17 tahun 2000 tentang Pajak Penghasilan.

http://pusat.baznas.go.id/profil/ diakses tanggal 30 Nopember 2017.

DOI: https://doi.org/10.18860/ua.v18i2.4412

Refbacks

- There are currently no refbacks.

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

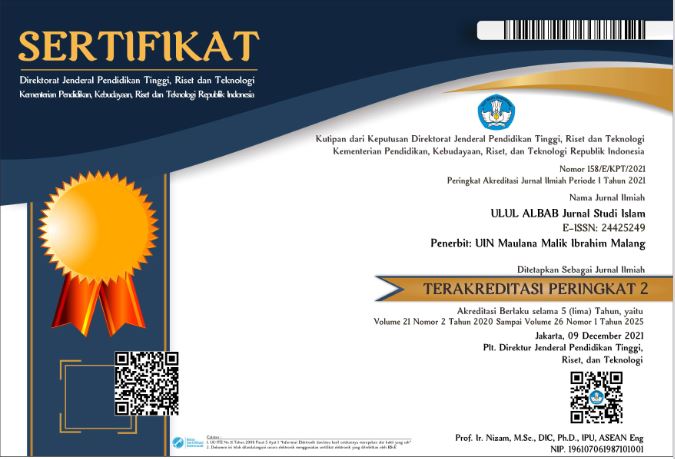

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249