KEBIJAKAN FISKAL ZAKAT DAN PAJAK PADA PEREKONOMIAN (Studi Komparatif Ekonomi Islam, Klasik dan Keynes)

Abstract

This paper studies difference of analysis policy of fiscal religious obligatory (zakat) and tax in chartered investment counsel Classic, Keynes and Islam chartered investment counsel. In Islam chartered investment counsel there is religious obligatory which must be packed into model calculation earnings, because religious obligatory that with existence of religious obligatory will give larger one in economics through effect multiplier compared to chartered investment counsel system Classical and Keynes which only apply tax. It also argues that given the requirements of Muslim countries a direct tax and zakat on personal consumption expenditure. It would be comparable effect of direct taxes and zakat on their systems. Its introduction would help in financing a high level of economic development. Since it is highly anti-inflationary, its introduction would help in controlling inflation and achieving much desired price stability. More importantly, an expenditure tax by favoring saving vis-ai-vis consumption would expand zakat base. In order to realize these advantages an attempt is made in this paper to develop a workable model of an expenditure tax and zakat which would incorporate within itself the shariah based prescriptions. Profit and loss sharing, categorization of saving the creation of national equity fund are some of its prominent features.

Keywords

Full Text:

PDFReferences

Agustianto. 2002. Percikan Pemikiran Ekonomi Islam. Bandung.

Agustianto. 2006. The Death Of Economics Dan Chance Ekonomi Syariah.(Online), www.pesantrenvirtuaLcom.

Algifari, GM. 1998. Teori Ekonomi Makro. Yogyakarta: BPFE UGM.

Chapra, U. 2002. The Future of Economics: An Islamic Perspective: Lanscape Baru Perekonomian Masa Depan. Jakarta: Tim Penerbit SEBI.

Harian Republika. 19 Januari 2004.Data Bank Indonesia. ha!. 16.

Harian Republika. 6 Januari 2004. Data Direktorat Bank Syari'ah Bank Indonesia. ha!. 16.

Gregory, M. 2000. Teori Ekonomi Makro. Terj. Imam Nurmawan. Edisi Keempat. Jakarta: Penerbit Erlangga.

Mannan, MA. 1997. Teori dan Praktek Ekonomi Islam, Yogyakarta: PT. Dana Bhakti Wakaf.

Manzer, K. 1989. Zakat in Macro Economic Context. (Online), www.kahfnet/articles/english/.

DOI: https://doi.org/10.18860/ua.v9i2.6215

Refbacks

- There are currently no refbacks.

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

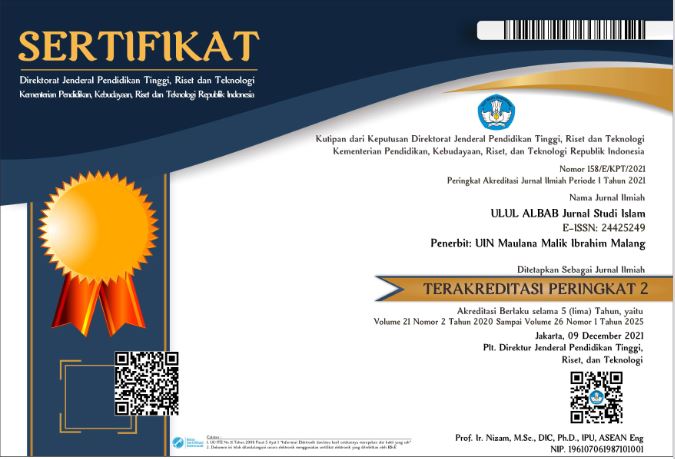

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249