ANALISIS PENGARUH INFLASI DAN TINGKAT SUKU BUNGA SBI TERHADAP OBLIGASI SYARIAH MUDHARABAH DAN IJARAH DI INDONESIA

Abstract

Keywords

Full Text:

PDFReferences

Achsien, Iggi H, 2003. Investasi Syariah di Pasar Modal, Penerbit PT.Gramedia Pustaka Utama, Jakarta.

BAPEPAM, 2003. Panduan Investasi Di Pasar Modal Indonesia, Penerbit Badan Pengawas Pasar Modal (BAPEPAM) Bekerjasama Dengan Japan International Cooperation Agency.

Brigham, Eugene F, 2001. ManajemenKeuangan (EdisiKedelapan), Penerbit PI Erlangga, Jakarta.

Buku Materi Islamic Banking Training Goes To Campus 2004. Universitas Brawijava Malang.Griffin, dkk, 1996. Bisnis, Prenhallindo, Jakarta.

Hidaya, Kanny, 2003. da1am Buku Materi Workshop Pasar Modal Syariah Obligasi, Makalah tidak diterbitkan.

Himpunan Fatwa Dewan Syariah National (DSN) Edisi Kedua, 2003. Penerbit PI' lntermasa, Jakarta.

Husnan, Suad dkk., 1993. Dasar-dasar Teori Porlofolio dan Analisis Sekutas, Penerbit UPP AMP YKPN, Yogyakarta.

Nopirin. 2000. Ekonomi Moneter. Edisi Pertama. Yogyakarta: BPFE.

Panduan Investasi Di Pasar Modal Indonesia. Badan Pengawas Pasar Modal Bekerjasama Dengan Japan International Cooperation Agency. 2003.

Pontjowinoto, Iwan, 2003. dalam Buku Materi Workshop Pasar Modal Syariah Ohligasi.

Warkum, 2004. Asas-asas Perbankan Islam dan I.embaga-lembaga Terkait (BAMUI, TAKAFUL, dan Pasar Modal Syariah di Indonesia), Penerbit PT. Raja Grafmdo Persada, Jakarta.

Syafri Harahap, Sofyan, 1993. Teori Akuntansi (Edisi Revisi), Penerbit PT. Raja Grafmdo Persada, Jakarta.

Siamat, D. 2001. Manajemen Lembaga Keuangan . Edisin Ketiga Jakarta: Lembaga Penerbit FEUI.

Sumber Selain Buku;

Achsien, Iggi H, Makalah. Menginrip Peluang Obligasi Syariah.

Hulwati, 2005. Makalah. Legirimasi Obligasi Sebagai Instrumen Keuangan Islam.

Info Bank. 1998, April, Fokus Utama, pp7.

Majalah Modal, 2004, Edisi 23, Penerbit PT. Modal Multimedia, Jakarta.

Majalah Modal, 2005, Edisi 30, Penerbit PT. Modal Multimedia, Jakarta.

Tim Studi Tentang Investasi Syariah di Pasar Modal Indonesia, 2004.

Undang-undang Nomor 8 Tahun 1995 Tentang Pasar Modal

Yasni, M Gunawan, 2002. Mengenal Instrumen Pasar Modal Syariah, Republika.

Yasni, M Gunawan. Pembiayaan Syariah - Alternatif Pengembangan Pembiayaan Modal Ventura Indonesia.

Yasni, M Gunawan dalam Prospektif. Obligasi Syariah Menawarl

Februari 2006, http: //www. Tempointeraktif com/hg/ekbis/2005/10/06/brk,20051006-6 7616,id.html.

Februari 2006,tid,Republika) (syariahmandiri.co.id) http: 72.14

Mei 2006, http://vvww.kompas.eom/kompas-cetak/0403/l 7 /finansial/9 1 8272.htm.

Mei 2006, http://www.tempointeraktif.com/hg/ekbis/2005/08/08/brk,20050808-64973,id.html.

Achsien, lggi H. Mengenal Obligasi Syariah. 05 Mei 2006, http:/www.kompas.com/kompas.

Ekonomi Syariah Di Indonesia, 26 Mei 2006, http://www. tazkiaonline.com/arti.

Antonio, M Syafli. Riba dalam Perspektif Agama clan Sejarah (Terakhir), 18 Juli 2006, http://coolstuff.blubox.us/wp/?p: = 11 1.

DSN MUI, Fatwa Dewan Syariah Nasional Majelis Ulama Indonesia Nomor: 41 DSN-MUI/III/2004 Tentang Obligasi Syariah ljarah, 05 Mei 2006.

lnvestasi Pasar Modal /Keuangan Oilihat clan Perspeklif Islam, 26 Mei 2006, www.tazkiaonline.com.

Joe, Emiten Mulai Minati Obligasi Syariah ljarah, 06 Juni 2006,

http://www.kompas.eom/kompas-cetak/04030 7 lfirumsial/918272.htm.

Ngapon, SemarakPasar Modal Syariah, 05 Mei 2006,

http://www.bapepam.go.id/layanan/warta/2005 _ april/semarak syariah. pdf

Overview, 21 JuJi 2006, http://www.bes. co. id/about/overview.asp.

RepubJika Online, Skim ljarah Untuk Obligasi Prospektif, 06 Juni 2006, http://www. taziaonline. com/artikel. php=391.

DOI: https://doi.org/10.18860/ua.v9i1.6226

Refbacks

- There are currently no refbacks.

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

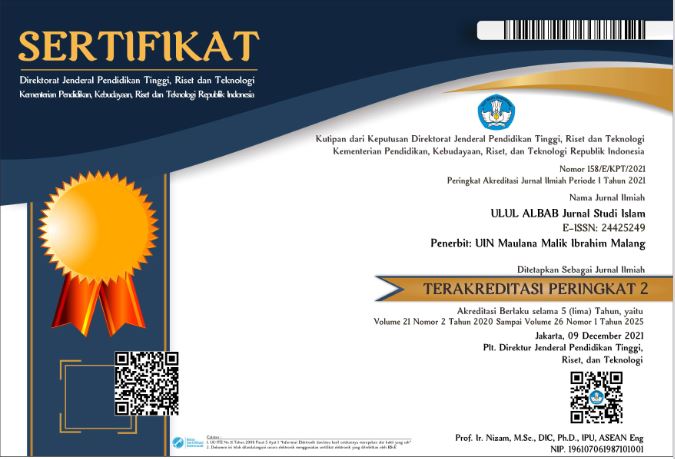

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249