IS IT FAIR TO ASSESS THE PERFORMANCE OF ISLAMIC BANKS BASED ON THE CONVENTIONAL BANK PLATFORM?

Abstract

Several studies found the weakness of using conventional performance measurement tools such as CAMELS and RGEC in Islamic banking and the lack of performance measurement tools following the characteristics of Islamic banks. This is the solid reason to have a performance measurement system that integrates the objectives of sharia and the business objectives of sharia banking. This study explores the application of maqâsi}d al-sharî‘ah values in Islamic banking and initiated a Sharia Integrated Performance Measurement (SIPM) structure. This is a library research. The primary data were collected through in-depth interviews with practitioners, experts, and academics of Islamic banking, while secondary data was taken from the literature and previous research that discussed the measurement of Islamic banking performance. The data were analyzed through several stages: data reduction, data display, and concluding with the help of the Atlas.ti application version 8. This study wants to contribute to the idea of building a Sharia Integrated Performance Measurement (SIPM) platform through three components: Islamic commercial performance, Islamic social performance, and Islamic macroeconomics performance in Islamic banking.

Keywords

Full Text:

PDFReferences

Aisjah, Siti, and Agustian Eko Hadianto. 2013. “Performance Based Islamic Performance Index (Study on the Bank Muamalat Indonesia and Bank Syariah Mandiri.” Asia Pacific Management and Business Application 2(2): 98–110. DOI: 10.21776/ub.apmba.2013.002.02.2.

Alexakis, Christos, Marwan Izzeldin, Jill Johnes, and Vasileios Pappas. 2019. “Performance and Productivity in Islamic and Conventional Banks: Evidence from the Global Financial Crisis.” Economic Modelling 79: 1–14. DOI: 10.1016/j.econmod.2018.09.030.

Ansong, Abraham. 2017. “Corporate Social Responsibility and Access to Finance among Ghanaian SMEs: The Role of Stakeholder Engagement” ed. Tahir Nisar. Cogent Business & Management 4(1): 1-13. DOI: 10.1080/23311975.2017.1385165.

Ascarya. 2014. “Membuat Indeks Kinerja LKS Berdasarkan Tujuan Syariah.” Iqtishodia: Jurnal Ekonomi Islam Republika II: 25.

Asutay, Mehmet, and Astrid Fionna Harningtyas. 2015. “Developing Maqasid l-Shari’ah Index to Evaluate Social Performance of Islamic Banks: A Conceptual and Empirical Attempt.” International Journal of Islamic Economics and Finance Studies 1(1): 60.

Bastan, Mahdi, Mohammad Bagheri Mazraeh, and Ali Mohammad Ahmadvand. 2016. “Dynamics of Banking Soundness Based on CAMELS Rating System.” The 34th International Conference of the System Dynamic Society: 14.

Bedoui, M. Houssem eddine. 2012. “Shariah-Based Ethical Performance Measurement Framework الإطار القائم على الشريعة لمقياس الأداء الأخلاقي.” In Chapters of Books Published by the Islamic Economics Institute, KAAU or Its Faculty Members., King Abdulaziz University, Islamic Economics Institute., 521–38. https://ideas.repec.org/h/abd/ieibch/707.html (February 24, 2021).

Bedoui, M. Houssem Eddine, and Walid Mansour. 2015. “Performance and Maqasid al-Shari’ah’s Pentagon-Shaped Ethical Measurement.” Science and Engineering Ethics 21(3): 555–76. DOI: 10.1007/s11948-014-9561-9.

Berger, Allen N., Narjess Boubakri, Omrane Guedhami, and Xinming Li. 2019. “Liquidity Creation Performance and Financial Stability Consequences of Islamic Banking: Evidence from a Multinational Study.” Journal of Financial Stability 44: 100692. DOI: 10.1016/j.jfs.2019.100692.

Chapra, M. Umer, Shiraz Khan, and A. S Al-Shaikh-Ali. 2008. 15 The Islamic Vision of Development in the Light of Maqâsi{d al-Sharî'ah. London: International Institute of Islamic Thought.

Dusuki, Asyraf Wajdi. 2008. “Understanding the Objectives of Islamic Banking: A Survey of Stakeholders’ Perspectives.” International Journal of Islamic and Middle Eastern Finance and Management 1(2): 132–48. DOI: 10.1108/17538390810880982.

Farag, Hisham, Chris Mallin, and Kean Ow-Yong. 2018. “Corporate Governance in Islamic Banks: New Insights for Dual Board Structure and Agency Relationships.” Journal of International Financial Markets, Institutions and Money 54: 59–77. DOI: 10.1016/j.intfin.2017.08.002.

Haniffa, Roszaini, and Mohammad Hudaib. 2007. “Exploring the Ethical Identity of Islamic Banks via Communication in Annual Reports.” Journal of Business Ethics 76(1): 97–116. DOI: 10.1007/s10551-006-9272-5.

Hazman, Samsudin, Nawawi Mohd Nasir, Abd Halim Zairihan, and Said Ahmad Syahmi. 2018. “Financial Performance Evaluation of Islamic Banking System: A Comparative Study among Malaysia’s Banks.” Jurnal Ekonomi Malaysia 52 (2): 137-48. DOI: http://dx.doi.org/10.17576/JEM-2018-5202-11.

Hudaefi, Fahmi Ali, and Kamaruzaman Noordin. 2019. “Harmonizing and Constructing an Integrated Maqâs{id al-Sharî'ah Index for Measuring the Performance of Islamic Banks.” ISRA International Journal of Islamic Finance 11(2): 282–302. DOI: 10.1108/IJIF-01-2018-0003.

Jan, Amin, Maran Marimuthu, and Muhammad Pisol bin Mohd Mat Isa. 2019. “The Nexus of Sustainability Practices and Financial Performance: From the Perspective of Islamic Banking.” Journal of Cleaner Production 228: 703–17. DOI: 10.1016/j.jclepro.2019.04.208.

Julia, Taslima, and Salina Kassim. 2019. “Exploring Green Banking Performance of Islamic Banks vs Conventional Banks in Bangladesh Based on Maqasid Shariah Framework.” Journal of Islamic Marketing 11(3): 729–44. DOI: 10.1108/JIMA-10-2017-0105.

Kamla, Rania, Sonja Gallhofer, and Jim Haslam. 2006. “Islam, Nature and Accounting: Islamic Principles and the Notion of Accounting for the Environment.” Accounting Forum 30(3): 245–65. DOI: 10.1016/j.accfor.2006.05.003.

Khan, Tahseen Mohsan, Hamza Rizwan, Saima Akhtar, and Syed Waqar Azeem Naqvi. 2017. “How Efficient Is the Islamic Banking Model in Pakistan?”. The Lahore Journal of Business 6(1): 111-125. DOI: 10.35536/ljb.2017.v6.i1.a6.

Maali, Bassam, Peter Casson, and Christopher Napier. 2006. “Social Reporting by Islamic Banks.” Abacus 42(2): 266–89. DOI: 10.1111/j.1467-6281.2006.00200.x.

Mohamed, Ehab K. A. 2010. “Multidimensional Performance Measurement In Islamic Banking.” Global Journal of Business Research 4(3): 47–60.

Mohammed, Mustafa Omar, Dzuljastri Abdul Razak, and Fauziah Md Taib. 2008. “The Performance Measures of Islamic Banking Based on the Maqasid Framework.” In Paper of IIUM International Accounting Conference (INTAC IV) Held at Putra Jaya Marroitt, 1–17.

Mohammed, Mustafa Omar, and Fauziah Md Taib. 2015. “Developing Islamic Banking Performance Measures Based on Maqasid Al_syariah Framework: Cases of 24 Selected Banks.” Journal of Islamic Monetary Economics and Finance (Augst): 55–77. DOI: 10.21098/jimf.v1i1.483.

Mulawarman, Aji Dedi. 2007. “Menggagas Neraca Syariah Berbasis Maal: Kontekstualisasi’’Kekayaan Altruistik Islami.” Jurnal Akuntansi dan Keuangan Indonesia 4(2): 169–92. DOI: 10.21002/jaki.2007.09.

Niswatin. 2017. Kinerja Manajemen Perbankan Syariah. Yogyakarta: Zahir Publishing.

Noorjaya, Tika. 2001. Sharia Banks as an Alternative Source of Finance for Small and Medium Entreprises in Indonesia (Bahasa Indonesia). Jakarta: ADB Technical Assistance.

Oktaviansyah, Hendrik Tri, Ahmad Roziq, and Agung Budi Sulistiyo. 2018. “ANGELS Rating System for Islamic Banking Industry in Indonesia.” Jurnal Keuangan dan Perbankan 22 (1): 1170-180. DOI: 10.26905/jkdp.v22i1.1563.

Prasetyo, Luhur. 2019. “Sistem Penilaian Kinerja Finansial dan Sosial Bank Syariah Perspektif Maqasid al-Najjar.” UIN Sunan Ampel Surabaya.

Prasetyowati, Lia Anggraeni, and Luqman Hakim Handoko. 2019. “Pengukuran Kinerja Bank Umum Syariah Dengan Maqasid Index Dan Sharia Conformity and Profitability (SCNP).” Jurnal Akuntansi dan Keuangan Islam 4(2): 107–30. DOI: 10.35836/jakis.v4i2.22.

Rafiq, Md. Rafiqul Islam, and Md. Rafiqul Islam Rafiq. 2016. “Determining Bank Performance Using CAMEL Rating: A Comparative Study on Selected Islamic and Conventional Banks in Bangladesh.” Asian Business Review 6(3): 151–60. DOI: 10.18034/abr.v6i3.40.

Rosmanidar, Elyanti, Abu Azam Al Hadi, and Muhamad Ahsan. 2021. “Islamic Banking Performance Measurement: A Conceptual Review of Two Decades.” International Journal of Islamic Banking and Finance Research 5(1): 16–33. DOI: 10.46281/ijibfr.v5i1.1056.

Sekaran, Uma, and Roger Bougie. 2013. Research Methods for Business: A Skill-Building Approach. Seventh. United Kingdom: John Wiley & Sons.

Soediro, Achmad, and Inten Meutia. 2018. “Maqasid Syariah as a Performance Framework for Islamic Financial Institutions.” Jurnal Akuntansi Multiparadigma 9(1): 70-86. DOI: 10.18202/jamal.2018.04.9005.

Sofyani, Hafiez, Ihyaul Ulum, and Daniel Syam. 2012. “Islamic Social Reporting Index sebagai Model Pengukuran Kinerja Sosial Perbankan Syariah (Studi Komparasi Indonesia dan Malaysia).” Jurnal Dinamika Akuntansi 4(1): 11. DOI: https://doi.org/10.15294/jda.v4i1.1958.

Strauss, Anselm, and Juliet Corbin. 1994. “Grounded Theory Methodologi: An Overview.” In Handbook of Qualitative Research, Thousand Oaks: Sage Publications, 273–85.

Sudarsono, Heri. 2018. Bank Dan Lembaga Keuangan Syariah; Deskripsi Dan Ilustrasi. Ekonisia FE UII.

Sugiyono. 2019. Metode Penelitian Kuantitatif, Kualitatif dan R & D. 1st ed. Bandung: Alfabeta.

Triyuwono, Iwan. 2001. “Metafora Zakat Dan Shari’ah Enterprise Theory Sebagai Konsep Dasar Dalam Membentuk Akuntansi Syari’ah.” Jurnal Akuntansi dan Auditing Indonesia 5(2): 131–45.

Triyuwono, Iwan. 2011. “Angels: Sistem Penilaian Tingkat Kesehatan (TKS) Bank Syari'ah.” Jurnal Akuntansi Multiparadigma 2(1): 1–21. DOI: 10.18202/jamal.2011.04.7107.

Yuliana, Indah. 2010. “Implementasi Pendistribusian Dana Zakat Infaq dan Shadaqah (ZIS) Perbankan Syariah Untuk Pemberdayaan Usaha Kecil Mikro (UKM) di Malang.” Ulul Albab: Jurnal Studi Islam 11(1): 79-110. DOI: 10.18860/ua.v0i0.2409.

DOI: https://doi.org/10.18860/ua.v23i1.15473

Refbacks

- There are currently no refbacks.

Tools:

Indexed By:

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

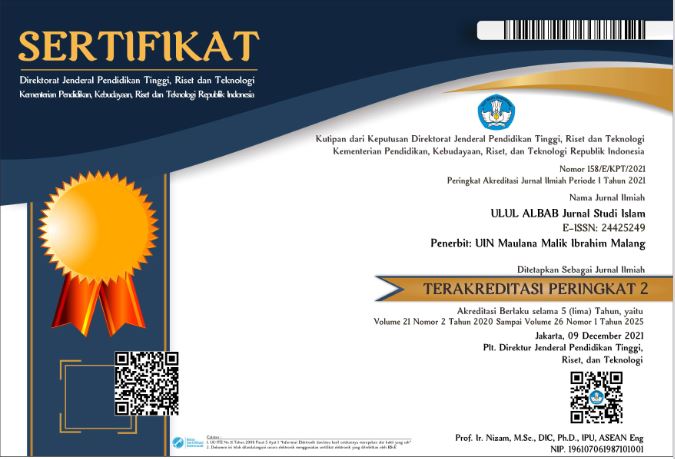

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249