THE ACCOUNTABILITY OF ZAKAT AL-FITR MANAGEMENT BY RELIGIOUS FIGURES AS ÂMIL AL-ZAKÂT

Abstract

This article aims to find out the accountability of zakat management done by the community leaders or Kiai who do not have documentation in funding and distribution. This study uses the case study approach, one of approaches in qualitative research, which uses interview and observation as the instruments of data collection. The result reveals that accountability, accounting, and functional perspectives have been fulfilled in the zakat management by Kiai. However, two of five characteristics of the accountability system perspective cannot be fulfilled by Kiai as âmil al-zakât, those are the written data presentation and the data publication. In other words, internally what Kiai does in the zakat management is very accountable. This is because of his science integrity and spirituality. In terms of external accountability loaded with document and neat presentation of data, Kiai somehow cannot fulfill it. This is because the period of management of zakat al-fitr is very short (only a few hours) and the target of zakat distribution is real and known.

Keywords

Full Text:

PDFReferences

Abdurrahman. 2010. Ekonomi al Ghazali : Menelusuri Konsep Ekonomi Islam Dalam Ihya Ulumuddin. Surabaya: PT Bina Ilmu.

Abdurrahman. 2022. “Interview with Muzakki. Madura.”

Aflah, Kuntarno Noor. 2018. “Urgensi Penetapan Kriteria Fakir Miskin Bagi Penyaluran Zakat di Indonesia.” Ziswaf : Jurnal Zakat dan Wakaf 4(1): 167. DOI 10.21043/ziswaf.v4i1.3037.

Akhyar Adnan, Muhammad. 2017. “The Need of Establishment of Professional Amil Zakat to Enhance the Future Zakat Development.” International Journal of Zakat 2(1): 71–79. DOI 10.37706/ijaz.v2i1.16.

Al-Arif, M Nur Rianto. 2013. “Optimalisasi Peran Zakat dalam Memberdayakan Perekonomian Umat.” Ulul Albab: Jurnal Studi Islam 14 (1):1-15. DOI 10.18860/ua.v0i0.2320.

Alam, Ahmad. 2018. “Permasalahan dan Solusi Pengelolaan Zakat di Indonesia.” Jurnal Manajemen 9(2): 128. DOI 10.32832/jm-uika.v9i2.1533.

Astuti, Suci. 2016. “The Analysis of Amil Competency and Its Effects on The Implementation of Zakat on Amil Zakat Institution.” Accounting Analysis Journal 5(3): 8. DOI https://doi.org/10.15294/aaj.v5i3.12744.

Atabik, Ahmad. 2015. “Peranan Zakat dalam Pengentasan Kemiskinan.” Jurnal Zakat dan Wakaf 2(2): 23.

Canggih, Clarashinta, Khusnul Fikriyah, and Ach Yasin. 2017. “Potensi dan Realisasi Dana Zakat Indonesia.” al-Uqud: Journal of Islamic Economics 1(1): 13. DOI https://doi.org/10.26740/al-uqud.v1n1.p14-26.

Endahwati, Yosi Dian. 2014. “Akuntabilitas Pengelolaan Zakat, Infaq, dan Shadaqah (ZIS).” Jinah : Jurnal Ilmiyah Akuntansi dan Humanika 4(1): 24. DOI https://doi.org/10.23887/jinah.v4i1.4599

Fadli, Ahmad. 2015. “Good Governance Zakat di Indonesia.” Jurnal al-Iqtishadi 2(1): 18.

Fariyansyah, Ardy, Gugus Irianto, and Roekhudin Roekhudin. 2018. “Akuntabilitas Vertikal-Horizontal Aparatur Publik dalam Perspektif Interpretatif Phenomenology Heidegger.” Jurnal Akuntansi Aktual 5(2): 168–77. DOI 10.17977/um004v5i22018p168.

Federspiel, Howard M. 2002. Contemporary Southeast Asian Muslim Intellectuals: An Examination of the Sources for Their Concepts and Intellectual Constructs, In Islam in the Era of Globalization: Muslim Attitudes Towards Modernity and Identity. Edited by Johan Hendrik Mauleman. London and New York: Routledge Curzon.

Ghofar, M. Abdul. 2010. Fiqih Wanita. Jakarta: Pustaka al- Kautsar.

Hamidi, Syukron. 2021. Interview with Muzakkî. Madura.

Hari, Muhammad. 2008. Kebiasaan Masyarakat Menyerahkan Zakat Fitrah Kepada Kiai (Studi Kasus Di Desa Sopa’ah Kecamatan Pademawu Kabupaten Pamekasan). Pamekasan: Jurusan Syari’ah, Program Studi al-Ahwal al-Syahksiyah, STAIN Pamekasan. http://opacperpus.iainmadura.ac.id/index.php?p=show_detail&id=899&keywords= (July 10, 2021).

Hefni, Moh. 2007. “(Studi Konstruktivisme-Strukturalis tentang Hierarkhi Kepatuhan dalam Budaya Masyarakat Madura).” Karsa XI(1): 10. DOI https://doi.org/10.19105/karsa.v11i1.144.

Herdianto, Ahmad Wahyu. 2011. “Peran Negara dalam Mengoptimalkan Zakat di Indonesia.” Jurisdictie, Jurnal Hukum dan Syariah 2(1): 14. DOI https://doi.org/10.18860/j.v0i0.1581.

Jaelani, Aan. 2015. Manajemen Zakat di Indonesia dan Brunei Darussalam. Cirebon: Nurjati Press.

Johari, Fuadah, Muhammad Ridhwan Ab Aziz, Mohd Faisol Ibrahim, and Ahmad Fahme Mohd Ali. 2013. “The Roles of Islamic Social Welfare Assistant (Zakat) for the Economic Development of New Convert.” Middle-East Journal of Scientific Research 18(3): 10. DOI 10.5829/idosi.mejsr.2013.18.3.12368.

Kementerian Agama RI. 2013. Panduan Zakat Praktis. Jakarta: Kementerian Agama RI Direktorat Masyarakat Islam Direktorat Pendayagunaan Zakat.

Jumali. 2021. Interview with Kiai. Madura.

Khatijah. 2022. Interview with Mustahiq. Madura.

Latif. 2022. Interview with Kiai. Madura.

Maftuh. 1992. Mutiara Hadits: Shahih Bukhari. Jakarta: CV. Bintang Pelajar.

Mohd Ali, Ahmad Fahme, Zakariah Abd. Rashid, Fuadah Johari, and Muhammad Ridhwan Ab. Aziz. 2015. “The Effectiveness of Zakat in Reducing Poverty Incident: An Analysis in Kelantan, Malaysia.” Asian Social Science 11(21): 355. DOI 10.5539/ass.v11n21p355.

Muammar. 2022. Interview with Lenteng Village Head. Madura.

Mubarak, Hosni. 2022. Interview with Kiai. Madura.

Musnandar, Aries. 2017. “Managemen Inklusif dengan Prinsip Maqashid al Syariah dalam Penghitungan Zakat dan Pajak.” Ulul Albab: Jurnal Studi Islam 18(2): 221. DOI: 10.18860/ua.v18i2.4412.

Navilah, Ila. 2013. Persepsi Muzakki Tentang Zakat Dan Peran Kiai Terhadap Upaya Optimalisasi Pengelolaan Dan Perindustrian Zakat Pada Badan Amil Zakat Kabupaten Cirebon (Studi Kasus Tentang Upaya Optimalisasi Pengelolaan Dan Pendistribusian Zakat Di Kecamatan Astanajapura Kabupaten Cirebon). Cirebon: IAIN Syekh Nurjati Cirebon. Skripsi.

Permono, Sjechul Hadi. 1992. Pemerintah RI Sebagai Pengelola Zakat. Jakarta: Pustaka Firdaus.

Raba, Manggaukang. 2020. Akuntabilitas : Konsep Dan Implementasi. Malang: UMM Press.

Rédha, Bouchikhi Mohamed, Ghrissi Larbi, and Rahmani Mira Karima. 2016. “The Impact of Zakat Fund in Reducing Poverty Case of Algeria.” Mediterranean Journal of Social Sciences 7(3): 256-264. DOI 10.5901/mjss.2016.v7n3p256.

Rochana, Totok. 2012. “Orang Madura: Suatu Tinjauan Antropologis.” Humanus 11(1): 46. DOI10.24036/jh.v11i1.622.

Sadjiarto, Arja. 2000. “Akuntabilitas dan Pengukuran Kinerja Pemerintahan.” Jurnal Akuntansi 2(2): 13. DOI https://doi.org/10.9744/jak.2.2.pp.%20138-150.

Sanusi, Makhda Intan. 2021. “Skala Prioritas Penentuan Mustahiq Zakat Di Lembaga Amil Zakat (LAZ) Ummat Sejahtera Ponorogo.” Lisyabab Jurnal Studi Islam dan Sosial 2(1): 16.

al-Shâtibî, Abû Ishâq. 2004. Al-Muwâfaqât fî Usûl al Sharî‘ah. Beirut: Dâr Kutub al ‘Ilmîyah.

Setiawan, Adi, and Trisno Wardy Putra. 2020. “Analisis Kebijakan BAZNAS tentang Ibnu Sabil sebagai Mustahik Zakat.” Ar-Ribh: Jurnal Ekonomi Islam 3(2): 19. DOI https://doi.org/10.26618/jei.v3i2.4255.

Suaidi. 2010. “Persepsi Masyarakat Pesisir Madura Terhadap Mustahiq Zakat (Kajian Atas Pemberian Zakat Fitrah Kepada Kiai Di Dusun Laok Tambak, Desa Padelegan, Kec. Pademawu, Kab. Pamekasan).” Jurisdictie, Jurnal Hukum dan Syariah 1(2): 53-58. DOI https://doi.org/10.18860/j.v0i0.1735.

Sugiono. 2017. Metode Penelitian: Kuantitatif, Kualitatif Dan R&D. Bandung: Alfabeta.

Suhaib, Abdul Quddus. 2009. “Contribution of Zakat in the Social Development of Pakistan.” Pakistan Journal of Social Sciences (PJSS) 29(2): 22.

Triantini, Zusiana Elly. 2010. “Perkembangan Pengelolaan Zakat di Indonesia.” 3(1): 14.

Wibowo, Arif. 2015. “Distribusi Zakat dalam Bentuk Penyertaan Modal Bergulir sebagai Accelerator Kesetaraan Kesejahteraan.” Jurnal Ilmu Managemen 12(2): 28–43. DOI 10.21831/jim.v12i2.11747.

Wiyata, Latief. 2020. Carok; Konflik Kekerasan Dan Harga Diri Orang Madura. Yogyakarta: LKiS.

Zuhri, Syaifuddin. 2012. Zakat Di Era Reformasi. Semarang: FITK UIN Walisongo.

DOI: https://doi.org/10.18860/ua.v23i1.15507

Refbacks

- There are currently no refbacks.

Tools:

Indexed By:

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

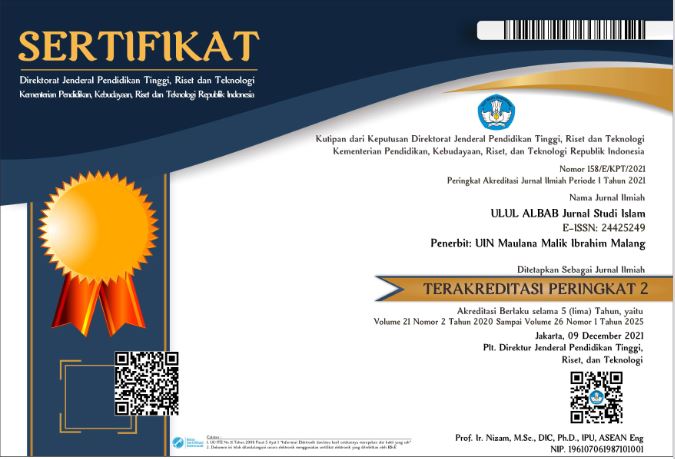

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249