FUNDING COMPATIBILITY OF THE HALAL INDUSTRY BASED ON THE ABNORMAL RATE OF ISSI STOCK RETURN

Abstract

This article aims to test the suitability of sharia funding by referring to the MUI Fatwa on the halal industry in the Indonesian capital market with a benchmark of sharia compliance based on. Event study before and after the Covid-19 pandemic, where the focus of the problem and the hypothesis of this research is on whether there is a change in the level of abnormal Return of the 30 ISSI stock samples. Observations were made before the government's announcement about Covid-19 pandemic, which was around the end of january 2020 and after entering the new normal, which was around the beginning of August 2020. The results of this study indicate that the significant figures both before and after the Covid-19 pandemic on ISSI sharia shares are less than 0.05, which means that ISSI shares do not have abnormal returns, so the research results are in line with the MUI Fatwa Article 5 concerning Securities Transactions. Article 5 discusses transaction mechanisms that are not allowed such as gharâr, maysîr, usurî, and risywah speculating and manipulation. To be appropriate because what is meant by abnormal returns in the capital market is often influenced by speculation and manipulation so that prices are no longer reasonable. The research hypothesis is rejected as an alternative to continuously to trust investor funding in the Indonesian islamic capital market industry.

Keywords

Full Text:

PDFReferences

Abdalloh, Irwan. 2018. Pasar Modal Syariah. Jakarta: PT. Elex Media Komputindo.

Adi Warman Karim. 2018. Ekonomi Mikro Islami. Jakarta: Raja Grafindo Persada.

Amin, Ma’ruf. 2008. Fatwa Dalam Sistem Hukum Islam. Jakarta: Elsas.

Arfan, Abbas. 2017. “Tipologi Multiakad Dalam Produk Fatwa Dewan Syariah Nasional-Majelis Ulama Indonesia Perspektif Teori Dan Batasan Multiakad Al ‘Imrani.” Ulul Albab: Jurnal Studi Islam 18(2): 269. DOI: 10.18860/ua.v18i2.4787.

Dewi, Septy Kurnia Fidhayatin & Nurul Hasanah Uswati. 2012. “Analisis Nilai Perusahaan, Kinerja Perusahaan dan Kesempatan Bertumbuh Perusahaan Terhadap Return Saham pada Perusahaan Manufaktur yang Listing di BEI.” The Indonesian Accounting Review 2(2): 203–14. DOI: http://dx.doi.org/10.14414/tiar.v2i02.96.

Erni Umi Hasanah. 2018. Pengantar Ilmu Ekonomi Makro ; Teori Dan Soal. Yogyakarta: Penerbit Cabs.

Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. “The Adjustment of Stock Prices to New Information.” International Economic Review 10(1): 1-21. DOI: https://doi.org/10.2307/2525569

Frank K. Reilly, Keith C. Brown, Sanford J. Leeds. 2019. Investment Analysis & Portfolio Management. Boston: Cengage.

Hanafi, Syafiq M. 2013. “Bukti Empiris Nilai Ekonomik Pada Pengumuman Daftar Efek Syariah (DES) Di Indonesia.” Jurnal Ilmu Syari’ah dan Hukum 47(2): 675–702. DOI: http://dx.doi.org/10.14421/ajish.2013.47.2.%25p.

Husnan, Suad. 2001. Dasar-Dasar Teori Portofolio Dan Analisis Sekuritas. Ketiga. Yogyakarta: UPP AMP YKPN.

Jogiyanto. 2010. Teori Portofolio Dan Analisis Investasi. Yogyakarta: BPFE.

Kartika, Rayna. 2022. “Analisis Abnormal Returns Dan Trading Volume Activities.” Fair Value: Jurnal Ilmiah Akuntansi dan Keuangan 4(5): 2076–83.

DOI: https://doi.org/10.32670/fairvalue.v4iSpesial%20Issue%205.1625

Mohammad Samsul. 2015. Pasar Modal Dan Manajemen Fortofolio. Jakarta: Erlangga.

Muhammad. 2014. Manajemen Keuangan Syariah: Analisis Fiqh Dan Keuangan. Yogyakarta: UPP STIM YKPN.

Nanda, N & Fajri Adrianto. 2019. “Abnormal Return Momentum Pada Saham Syariah Di Jakarta Islamic Indeks.” Jurnal Ilmiah Mahasiswa Ekonomi Manajemen 4(4): 773-785. DOI: https://doi.org/10.24815/jimen.v4i4.13011.

al-Qardâwî, Yûsuf. 1988. Al-Fatawâ Bain al-Indibât wa Tasayyub. Kairo: Dâr al Sahwah.

Rahardja, Prathama dan Mandala Manurung. 2008. Teori Ekonomi Makro. Jakarta: LPFEUI.

Razali Harun and Mukhtar Arif Siraj. 2021. “The Influence of Investment, Debt, and Dividend Policies on the Stock Return of Shariah Compliant Companies in Indonesia (ISSI).” Global Review of Islamic Economics and Business 9(2): 67–76. DOI: https://doi.org/10.14421/grieb.2021.092-06.

Septian Dwi Cahyo, Solicha. 2019. “Faktor-Faktor Yang Mempengaruhi Perilaku Faktor-Faktor Yang Mempengaruhi Perilaku.” Jurnal Bisnis dan Ekonomi (JBE) 22(2): 154–70.

Setiyawan, Edi, Ari Kristin Prasetyoningrum, and Dessy Noor Farida. 2020. “Analisis Perbedaan Abnormal Return Sebelum Dan Sesudah Pengumuman Jakarta Islamic Index.” Kompartemen: Jurnal Ilmiah Akuntansi 17(1): 69-84. DOI:10.30595/kompartemen.v17i1.3980.

Susianti, Nurul. 2017. “Analisis Optimalisasi Prinsip Lembaga Keuangan Syariah Non-Bank ‘Anomaly Event Study January Effect Terhadap Abnormal Return Saham Syariah (JII) di Pasar Modal Indonesia.’” Iqtishaduna 8(1):23-36. DOI: https://doi.org/10.20414/iqtishaduna.v8i1.358.

Widuhung, Sisca Debyola. 2014. “Perbandingan Return Dan Risiko Investasi Pada Saham Syariah Dan Emas.” Jurnal Al-Azhar Indonesia Seri Pranata Sosial 2(3): 144–50.

Zainal, Veithzal Rivai. 2016. Manajemen Investasi Islami. Yogyakarta: Fakultas Ekonomika dan Bisnis UGM.

DOI: https://doi.org/10.18860/ua.v23i1.15706

Refbacks

- There are currently no refbacks.

Tools:

Indexed By:

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

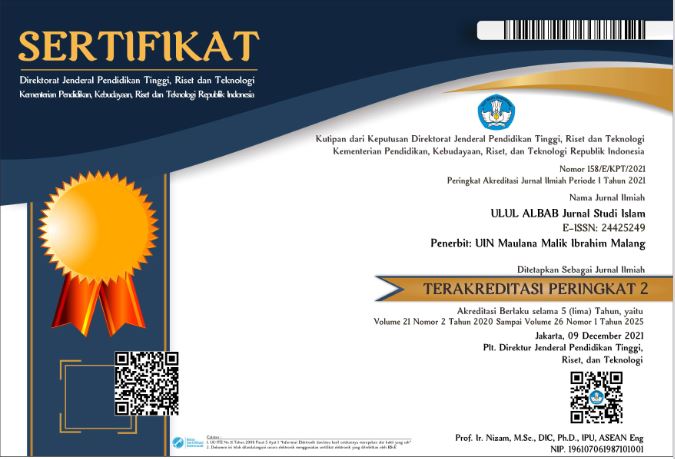

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249