ISLAMIC BANK CUSTOMER LOYALTY: An Analysis of Griffin's Theory and Relevant Research

Abstract

The study discusses the indicator of customer loyalty of Islamic banks according to Griffin's perspective and several relevant studies. The problems solved in this study are 1) what is the indicator of customer loyalty of Islamic banks according to Griffin? 2) what is the indicator of customer loyalty of Islamic banks according to some relevant studies? and 3) how is the comparison of Islamic bank customer loyalty indicators according to Griffin and other relevant studies? Based on the theoretical assumption, a customer is considered loyal if he/she makes regular purchase in a certain time interval. This study utilizes descriptive qualitative research with a library research approach. Deduction and comparative are done in analysis technique. Griffin’s theory focuses on behavioral and attitudinal approach. Meanwhile, other relevant research studies emphasize more on physical things, the availability of banking facilities and infrastructure. They also classified the loyalty into affective, conative, and action loyalty. There is a difference in Griffin’s theory and other studies, that customer loyalty is influenced by maqâsid al-sharî'ah. It means that the customer loyalty is determined by satisfactory level referring to sharia values.

Keywords

Full Text:

PDFReferences

Abd Ghani, M., Rahi, S., Mansour, M., Abed, H., & Alnaser, F. M. 2017.” Determinants of Customer Loyalty: The Role of Service Quality, Customer Satisfaction and Bank Image of Islamic Banks in Palestine.” International Journal of Economics & Management Sciences, 6(5): 1–4. DOI: https://doi.org/10.4172/2162-6359.1000461.

Abror, A., Patrisia, D., Engriani, Y., Evanita, S., Yasri, Y., & Dastgir, S. 2019. “Service Quality, Religiosity, Customer Satisfaction, Customer Engagement and Islamic Bank’s Customer Loyalty.” Journal of Islamic Marketing, 11(6): 1691–1705. DOI: https://doi.org/10.1108/JIMA-03-2019-0044.

Adams, D. A., Nelson, R. R., & Todd, P. A. 1992. “Perceived Usefulness, Ease of Use, and Usage of Information Technology: A Replication.” MIS Quarterly: Management Information Systems 16(2): 227–247. DOI: https://doi.org/10.2307/249577.

Afwadzi, B., & Miski, M. 2021. “Religious Moderation in Indonesian Higher Education: Literature Review.” Ulul Albab: Jurnal Studi Islam, 22(2): 203–231. DOI: https://doi.org/10.18860/ua.v22i2.13446.

Ahmad, N., & Haron, S. 2002. “Perceptions of Malaysian Corporate Customers Towards Islamic Banking Products and Services.” International Journal of Islamic Financial Services 3(4): 1-16.

Albaity, M., & Rahman, M. 2021. “Customer Loyalty Towards Islamic Banks: The Mediating Role of Trust and Attitude.” Sustainability (Switzerland) 13(19): 1–19. DOI: https://doi.org/10.3390/su131910758.

Amin, M. 2016. “Internet Banking Service Quality and its Implication on e-Customer Satisfaction and E-Customer Loyalty.” International Journal of Bank Marketing 34(3): 280–306. DOI: https://doi.org/10.1108/IJBM-10-2014-0139.

Amin, M., Isa, Z., & Fontaine, R. 2013. “Islamic Banks: Contrasting the Drivers of Customer Satisfaction on Image, Trust, and Loyalty of Muslim and non-Muslim Customers in Malaysia.” International Journal of Bank Marketing 31(2): 79–97. DOI: https://doi.org/10.1108/02652321311298627.

Arwani, M., & Suprehatin. 2011. “The Influence of Satisfaction and Relationship Marketing on Loyalty with Individual Characteristics as A Moderator: A Case Study on Islamic Banking Customers in East Java.” Journal of Indonesian Economy and Business 26(3): 341–358. DOI: https://doi.org/10.22146/jieb.6262.

Asnawi, N., Sukoco, B. M., & Fanani, M. A. 2019. “The Role of Service Quality within Indonesian Customers Satisfaction and Loyalty and Its Impact on Islamic Banks.” Journal of Islamic Marketing 11(1): 192–212. DOI: https://doi.org/10.1108/JIMA-03-2017-0033.

Assael, H. 2002. Consumer Behavior and Marketing Strategy. Cincinnati: South Western Collage Publishing.

Beerli, A., Martín, J. D., & Quintana, A. 2004. “A model of Customer Loyalty in the Retail Banking Market.” European Journal of Marketing 38(1/2): 253-275. DOI: https://doi.org/10.1108/03090560410511221.

Bügel, M. S., Verhoef, P. C., & Buunk, A. P. 2011. “Customer Intimacy and Commitment to Relationships with Firms in Five Different Sectors: Preliminary Evidence.” Journal of Retailing and Consumer Services 18(4): 247-258. DOI: https://doi.org/10.1016/j.jretconser.2010.11.005.

Caruana, A. 2002. “Service Loyalty: The Effects of Service Quality and the Mediating Role of Customer Satisfaction.” European Journal of Marketing, 36(7/8): 811–828. DOI: https://doi.org/10.1108/03090560210430818.

Choon Ling, K., Bin Daud, D., Hoi Piew, T., Keoy, K. H., & Hassan, P. 2011. Perceived Risk, Perceived Technology, Online Trust for the Online Purchase Intention in Malaysia. International Journal of Business and Management 6(6): 167–182. DOI: https://doi.org/10.5539/ijbm.v6n6p167.

Cronin, J. J., & Taylor, S. A. 1992. “Measuring Service Quality: A Reexamination and Extension.” Journal of Marketing 56(3): 55–68. DOI: https://doi.org/10.2307/1252296.

Darsono, L. I. 2004. “Loyalty & Disloyalty: Sebuah Pandangan Komprehensif dalam Analisa Loyalitas Pelanggan.” Kinerja Journal of Business and Economics 8(2):163-172.

Dewi, A., Najib, M., & Beik, I. S. 2018. “Effect of Qualities of Service and Funding Product on Brand Image and Loyalty of Sharia Bank Customers in Bogor.” Indonesian Journal of Business and Entrepreneurship 4(3): 308–319. DOI: https://doi.org/10.17358/ijbe.4.3.308.

Dick, A. S., & Basu, K. 1994. “Customer Loyalty: Toward an Integrated Conceptual Framework.” Journal of the Academy of Marketing Science 22(2): 99-113. DOI: https://doi.org/10.1177/0092070394222001.

Eid, R., & El-Gohary, H. 2015. “The Role of Islamic Religiosity on the Relationship Between Perceived Value and Tourist Satisfaction.” Tourism Management 46: 477–488. DOI: https://doi.org/10.1016/j.tourman.2014.08.003.

Fauzi, A. A., & Suryani, T. 2019. “Measuring the Effects of Service Quality by Using Carter Model Towards Customer Satisfaction, Trust and Loyalty in Indonesian Islamic Banking.” Journal of Islamic Marketing 10(1): 269–289. DOI: https://doi.org/10.1108/JIMA-04-2017-0048.

Gallarza, M. G., Gil-Saura, I., & Holbrook, M. B. 2011. “The Value of Value: Further Excursions on the Meaning and Role of Customer Value.” Journal of Consumer Behaviour 10(4): 179–191. DOI: https://doi.org/10.1002/cb.328.

Gao, S., Krogstie, J., & Siau, K. 2011. Developing an Instrument to Measure the Adoption of Mobile Services. Mobile Information Systems 7(1): 45–67. DOI: https://doi.org/10.3233/MIS-2011-0110.

Griffin, J. 2002. Customer Loyalty: How to Earn It, How to Keep It. Kentucky: Mc Graw Hill. https://media.wiley.com/product_data/excerpt/87/07879638/0787963887.pdf

Griffin, J. 2010. Customer Loyalty Menumbuhkan dan Mempertahankan Kesetiaan Pelanggan (Y. Sumiharti (ed.). Jakarta: Erlangga.

Han, H., & Hyun, S. S. 2018. “Role of Motivations for Luxury Cruise Traveling, Satisfaction, and Involvement in Building Traveler Loyalty.” International Journal of Hospitality Management 70: 75–84. DOI: https://doi.org/10.1016/j.ijhm.2017.10.024.

Harsoyo, T. D. 2009. “Perangkap Loyalitas Pelanggan: Sebuah Pemahaman Terhadap Noncomplainers Pada Seting Jasa.” Jurnal Manajemen Teori Dan Terapan 2(1): 1–19. https://e-journal.unair.ac.id/JMTT/article/download/2374/1729

Henrique, J. L., & de Matos, C. A. 2015. “The Influence of Personal Values and Demographic Variables on Customer Loyalty in the Banking Industry.” International Journal of Bank Marketing 33(4): 571–587. DOI: https://doi.org/10.1108/IJBM-06-2014-0082.

Hidayat, R., Akhmad, S., & Machmud, M. 2015. “Effects of Service Quality, Customer Trust and Customer Religious Commitment on Customers Satisfaction and Loyalty of Islamic Banks in East Java.” Al-Iqtishad: Journal of Islamic Economics 7(2): 151–164. DOI: https://doi.org/10.15408/ijies.v7i2.1681.

Horovitz, J. 2000. Seven Secrets of Service Strategy. New Jersey: Prentice Hall.

Hurriyati, R. 2010. Bauran Pemasaran dan Loyalitas Konsumen. Bandung: Alfabeta.

Ilmaniati, A., & Wiratmadja, I. I. 2016. “Pengembangan Model Loyalitas Nasabah Pada Perbankan Syariah (Bank Syariah Mandiri).” Journal of Engineering and Management in Industrial System 4(1): 94–101.

DOI: https://doi.org/10.21776/ub.jemis.2016.004.01.

Ireland, J. J. 2018. “Just How Loyal Are Islamic Banking Customers?”. International Journal of Bank Marketing 36(3): 410–422. DOI: https://doi.org/10.1108/IJBM-09-2016-0138.

Istikomah, & Mulazid, A. S. 2018. “Pengaruh Brand Image dan Kepercayaan Terhadap Loyalitas Nasabah PT. BNI Syariah Cabang Fatmawati Jakarta.” EQUILIBRIUM: Jurnal Ekonomi Syariah 6(1): 78–92. DOI: http://dx.doi.org/10.21043/equilibrium.v6i1.3086.

Jaffar, M. A., & Musa, R. 2014. “Determinants of Attitude towards Islamic Financing among Halal-certified Micro and SMEs: A Preliminary Investigation.” Procedia - Social and Behavioral Sciences 130: 135–144. DOI: https://doi.org/10.1016/j.sbspro.2014.04.017.

Järvinen, R. A. 2014. “Consumer Trust in Banking Relationships in Europe.” International Journal of Bank Marketing 32(6): 551-566. DOI: https://doi.org/10.1108/IJBM-08-2013-0086.

Karatepe, O. M., Yavas, U., & Babakus, E. 2005. “Measuring Service Quality of Banks: Scale Development and Validation.” Journal of Retailing and Consumer Services 12(5): 373–383. DOI: https://doi.org/10.1016/j.jretconser.2005.01.001.

Kassim, N. M., & Zain, M. M. 2016. “Quality of Lifestyle and Luxury Purchase Inclinations from the Perspectives of Affluent Muslim Consumers.” Journal of Islamic Marketing 7(1): 351–371. DOI: https://doi.org/10.1108/JIMA-08-2014-0052.

Kotler, P., & Keller, K. L. 2012. Marketing Management. London: Pearson Education International.

Kurniati, R. R., Arifin, Z., Hamid, D., & Suharyono. 2015. “The Effect of Customer Relationship Marketing (CRM) and Service Quality to Corporate Image, Value, Customer Satisfaction, and Customer Loyalty.” European Journal of Business and Management 7(11): 107–119. DOI: https://doi.org/10.1.1.735.5130.

Lada, S., Harvey Tanakinjal, G., & Amin, H. 2009. “Predicting Intention to Choose Halal Products Using Theory of Reasoned Action.” International Journal of Islamic and Middle Eastern Finance and Management 2(1): 66–76. DOI: https://doi.org/10.1108/17538390910946276.

Lovelock, C. 2002. Service Marketing. New Jersey: Prentice Hal Inc.

Mashuri, M. 2020. “Analisis Dimensi Loyalitas Pelangan Berdasarkan Perspektif Islam.” Iqtishaduna: Jurnal Ilmiah Ekonomi Kita 9(1): 54–64. DOI: https://doi.org/10.46367/iqtishaduna.v9i1.212

Mohsin Butt, M., & Aftab, M. 2013. “Incorporating Attitude towards Halal Banking in an Integrated Service Quality, Satisfaction, Trust and Loyalty Model in Online Islamic Banking Context.” International Journal of Bank Marketing 31(1): 6–23. DOI: https://doi.org/10.1108/02652321311292029.

Newaz, F. T., Fam, K. S., & Sharma, R. R. 2016. “Muslim Religiosity and Purchase Intention of Different Categories of Islamic Financial Products.” Journal of Financial Services Marketing 21(2): 141–152. DOI: https://doi.org/10.1057/fsm.2016.7.

Nurhayati, N., & Sukesti, F. 2016. “Peningkatan Loyalitas Nasabah Bank Syariah Melalui Peningkatan Kualitas Layanan dan Kepuasan Nasabah Dengan Variabel Religiusitas Sebagai Variabel Moderating (Studi Pada Bank Syariah Di Kota Semarang).” Economica: Jurnal Ekonomi Islam 7(2): 141–153. DOI: https://doi.org/10.21580/economica.2016.7.2.1158.

Oliver, R. L. 1999. “Whence Consumer Loyalty?” Journal of Marketing, 63: 33-44. DOI: https://doi.org/10.1177/00222429990634s105.

Oliver, R. L. 2010. Satisfaction: A Behavioral Perspective on the Consumer (13th ed.). New York: Mc Graw Hill. DOI: https://id1lib.org/book/2550139/4fe955.

Otoritas Jasa Keuangan, R. I. 2022. Statistik Perbankan Syariah - Desember 2021. https://www.ojk.go.id/id/kanal/syariah/data-dan-statistik/statistik-perbankan-syariah/Pages/Statistik-Perbankan-Syariah---Desember-2021.aspx

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. 1988. Servequal: A Multi-Item Scale for Measuring Customer Perception of Service Quality. Journal of Retailing 64(1): 12–40.

Pedersen, P. E., & Nysveen, H. 2004. Shopbanking: An-Experimental Study of Customer Satisfaction and Loyalty. 1–34. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.18.269&rep=rep1&type=pdf

Undang-Undang Republik Indonesia Nomor 21 Tahun 2008 Tentang Perbankan Syariah, Undang Undang Republik Indonesia (2008). DOI: https://doi.org/10.1017/CBO9781107415324.004.

Pourkiani, M., Goudarzvand Chegini, M., Yousefi, S., & Madahian, S. 2014. “Service Quality Effect on Satisfaction and Word of Mouth in Insurance Industry.” Management Science Letters 4(8): 1773–1780. DOI: https://doi.org/10.5267/j.msl.2014.7.006.

Puspopranoto, S. 2004. Keuangan Perbankan dan Pasar Keuangan. Jakarta: Pustaka LP3ES Indonesia.

Rahmat, J. 2005. Psikologi Komunikasi. Bandung: PT Remaja Rosdakarya. DOI: https://doi.org/10.1007/s00226-010-0382-y.

Ramdhani, M. A., Ramdhani, A., & Kurniati, D. M. 2011. “The Influence of Service Quality toward Customer Satisfaction of Islamic Sharia Bank.” Australian Journal of Basic and Applied Sciences 5(9): 1099–1104.

Ribbink, D., Streukens, S., Van Riel, A. C. R., & Liljander, V. 2004. “Comfort Your Online Customer: Quality, Trust and Loyalty on the Internet.” Managing Service Quality: An International Journal 14(6): 446–556. DOI: https://doi.org/10.1108/09604520410569784.

Rowley, J., & Dawes, J. 1999. “Customer Loyalty – a Relevant Concept for Libraries?.” Library Management 20(6): 345–351. DOI: https://doi.org/10.1108/01435129910280474.

Saleh, M. A., Quazi, A., Keating, B., & Gaur, S. S. 2017. “Quality and Image of Banking Services: A Comparative Study of Conventional and Islamic Banks.” International Journal of Bank Marketing 35(6): 878–902. DOI: https://doi.org/10.1108/IJBM-08-2016-0111

Sangadji, E. M., & Sopiah. 2013. Perilaku Konsumen: Pendekatan Praktis Disertai Himpunan Jurnal Penelitian. Yogyakarta: Andi Offset.

Sayani, H. 2015. “Customer Satisfaction and Loyalty in the United Arab Emirates Banking Industry.” International Journal of Bank Marketing 33(3): 351–375. DOI: https://doi.org/10.1108/IJBM-12-2013-0148.

Schiffman, L. G. dan L. L. K. 2008. Consumer Behavior. New Jersey: Prentice Hall.

Souiden, N., & Jabeur, Y. 2015. “The Impact of Islamic Beliefs on Consumers’ Attitudes and Purchase Intentions of Life Insurance.” International Journal of Bank Marketing 33(4): 423–442. DOI: https://doi.org/10.1108/IJBM-01-2014-0016.

Subagiyo, R. 2021. Pengaruh Determinan Ekuitas Merek, Nilai Nasabah dan Kepuasan Nasabah Terhadap Loyalitas Nasabah Bank Umum Syariah di Jawa Timur. Disertasi: UIN Sunan Ampel Surabaya. http://digilib.uinsby.ac.id/49911/

Subagiyo, R., Djamaluddin, B., & Ahsan, M. 2021. “Comparative Analysis of Customer Loyalty in Islamic and Conventional Banks: A Literature Review.” Al-Uqud: Journal of Islamic Economics 5(28): 97–118. DOI: https://doi.org/10.26740/al-uqud.v5n1.p97-118.

Suhartanto, D., Farhani, N. H., Muflih, M., & Setiawan. 2018. “Loyalty Intention towards Islamic Bank: The Role of Religiosity, Image, and Trust.” International Journal of Economics and Management 12(1): 137-151.

Suhartanto, D., Gan, C., Sarah, I. S., & Setiawan, S. 2019. “Loyalty towards Islamic banking: service quality, emotional or religious driven?”. Journal of Islamic Marketing11(1): 66–80. DOI: https://doi.org/10.1108/JIMA-01-2018-0007.

Sujianto, A. E., & Subagiyo, R. 2014. Membangun Loyalitas Nasabah. Yogyakarta: Lentera Kreasiondo.

Sumaedi, S., Juniarti, R. P., & Bakti, I. G. M. Y. 2015. “Understanding Trust & Commitment of Individual Saving Customers in Islamic Banking: The Role of Ego Involvement.” Journal of Islamic Marketing 6(3), 405–428. DOI: https://doi.org/10.1108/JIMA-06-2013-0045.

Sumitro, W. 2002. Asas-Asas Perbankan Islam dan Lembaga-Lembaga Terkait (BMI & Takaful) di Indonesia. Jakarta: Raja Grafindo Persada.

Sunyoto, D. 2015. Praktik Riset Perilaku Konsumen: Teori, Kuesioner, Alat, dan Analisis Data. Yogyakarta: CAPS.

Swastha, B. 2003. Azaz-azaz Marketing. Yogyakarta: Liberty. DOI: https://doi.org/10.1016/j.bandc.2009.12.003.Sound

Tabrani, M., Amin, M., & Nizam, A. 2018. “Trust, Commitment, Customer Intimacy and Customer Loyalty in Islamic Banking Relationships.” International Journal of Bank Marketing 36(5): 823–848. DOI: https://doi.org/10.1108/IJBM-03-2017-0054.

Tjiptono, F. 2014. Pemasaran Jasa. Yogyakarta: CV. Andi Offset. DOI: https://doi.org/10.1177/0300985809357753.

Tjiptono, Fandy, & Chandra, G. 2012. Pemasaran Strategik. Yogyakarta: CV. Andi Offset.

Tweneboah-Koduah, E., & Yuty Duweh Farley, A. 2015. “Relationship between Customer Satisfaction and Customer Loyalty in the Retail Banking Sector of Ghana.” International Journal of Business and Management 11(1): 249–261. DOI: https://doi.org/10.5539/ijbm.v11n1p249.

Vera, J., & Trujillo, A. 2013. “Service Quality Dimensions and Superior Customer Perceived Value in Retail Banks: An Empirical Study on Mexican Consumers.” Journal of Retailing and Consumer Services 20(6): 579–586. DOI: https://doi.org/10.1016/j.jretconser.2013.06.005.

Verhagen, T., Swen, E., Feldberg, F., & Merikivi, J. 2015. “Benefitting from Virtual Customer Environments: An Empirical Study of Customer Engagement.” Computers in Human Behavior 48: 340–357. DOI: https://doi.org/10.1016/j.chb.2015.01.061.

Wijaya, H., Beik, I. S., & Sartono, B. 2017. “Pengaruh Kualitas Layanan Perbankan Terhadap Kepuasan dan Loyalitas Nasabah Bank Syariah XYZ di Jakarta.” Jurnal Aplikasi Bisnis dan Manajemen 3(3): 417–426. DOI: https://doi.org/10.17358/jabm.3.3.417.

Wijayanti, T. 2017. Marketing Plan! Dalam Bisnis (Indonesian Edition). Jakarta: PT Elex Media Komputindo.

Zeithaml, V. A., Bitner, M. J., & Gremler, D. D. 2010. “Services Marketing Strategy.” In Wiley International Encyclopedia of Marketing. DOI: https://doi.org/10.1002/9781444316568.wiem01055.

DOI: https://doi.org/10.18860/ua.v23i1.15892

Refbacks

- There are currently no refbacks.

Tools:

Indexed By:

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

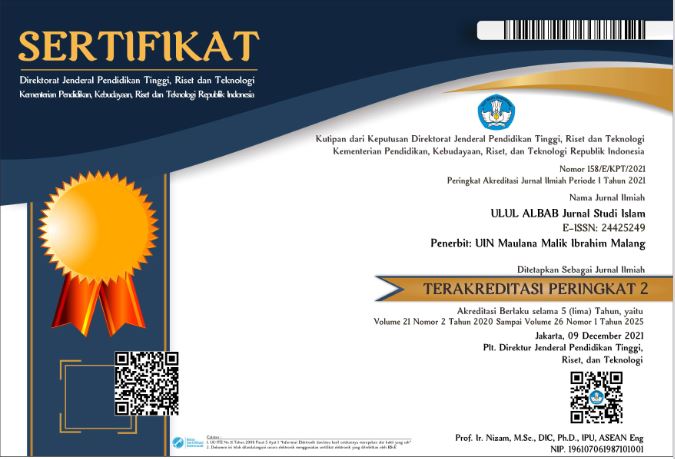

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249