THE BEHAVIOR OF BANKERS TOWARDS PROFIT AND LOSS SHARING CONTRACTS: A Modified Theory of Planned Behavior Approach

Abstract

This paper aims at determining the psychological factors of bankers in implementing Profit and Loss Sharing (PLS) financing contracts in Islamic banks. The phenomenon of low occurrence of PLS financing motivated the researcher to write this paper. The theory of modified planned behavior is used to explain the research problem. The research data were obtained from 139 employees of Islamic banks in Indonesia and processed using SEM-PLS. The results show that trust has an effect on attitudes; subjective attitudes and norms affect intentions; perceived behavioral control has no effect on intention and behavior; intention influences behavior; and the perception of inefficiency has a negative effect on the relationship between intention and behavior. This paper contributes to the elaboration of the psychological factors affecting the behavior of bankers in implementing PLS. The implications of this paper for designing the strategies to improve the bankers' behavior in PLS financing are: the management must boost the bankers' confidence for the PLS financing benefits; the stakeholder’s social pressure is needed; the authority of bankers in implementing PLS financing needs to be increased; the bankers' access to the partner’s financial reports needs to be expanded; and the regulators need to give appreciation to Islamic banks that have a larger PLS portfolio.

Keywords

Full Text:

PDFReferences

Abid, A., & Jie, S. 2022. Understanding Farmers’ Decision-Making to Use Islamic Finance Through the Lens of Theory of Planned Behavior. Journal of Islamic Marketing. DOI: https://doi.org/10.1108/JIMA-10-2020-0324.

Agriyanto, R. 2015. Redefining Objective of Islamic Banking; Stakeholders Perspective in Indonesia. Economica: Jurnal Ekonomi Islam, 6(2): 77-90. DOI: https://doi.org/10.21580/economica.2015.6.2.795

Ahmed, H. 2002. Incentive-Compatible Profit-Sharing Contracts: a Theoretical Treatment. In M. Iqbal & D. T. Llewellyn (Eds.), Chapters. Edward Elgar Publishing.

Ajzen, I. 1991. The Theory of Planned Behavior. Organizational Behavior and Human Decision Processes, 50(2): 179-211. DOI: https://doi.org/10.1016/0749-5978(91)90020-T

Anwer, Z., Khan, S., & Abu Bakar, M. 2020. Sharîah-Compliant Central Banking Practices: Lessons from Muslim Countries’ Experience. ISRA International Journal of Islamic Finance, 12(1): 7-26. DOI: https://doi.org/10.1108/IJIF-01-2019-0007

Ascarya. 2009. The Lack of Profit-and-Loss Sharing Financing in Indonesia’s Islamic Banks: Revisited. Jakarta: Centre of Education and Central Banking Studies, Bank Indonesia, 70-97. DOI: https://doi.org/10.13033/isahy2009.087

Bakar, S., & Yi, A. N. C. 2016. The Impact of Psychological Factors on Investors’ Decision Making in Malaysian Stock Market: A Case of Klang Valley and Pahang. Procedia Economics and Finance, 35: 319-328. DOI: https://doi.org/10.1016/S2212-5671(16)00040-X

Cohen, J. 1992. Statistical Power Analysis. Current Directions in Psychological Science, 1(3): 98-101. DOI: https://doi.org/10.1111/1467-8721.ep10768783

Davis, F. D. 1989. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13(3): 319. DOI: https://doi.org/10.2307/249008

Fakir, Adil EL et al. 2020. Can Real Options Reduce Moral Hazards in Profit and Loss Sharing Contracts?: A Behavioural Approach Using Game Theory and Agent Based Simulation. Journal of Islamic Business and Management, 10(2): 284-302. DOI: https://doi.org/10.26501/jibm/2020.1002-001

Fuadi, N. F. Z. et al. 2022. Halal Marketplace: The Influence of Attitude, Subjective Norms, and Perceived Behavior Control on Purchase Intention of Muslim Consumers. Shirkah: Journal of Economics and Business, 7(1): 100-112. DOI: https://doi.org/10.22515/shirkah.v7i1.451

Hair, J. F. et al. 2012. The use of partial least squares structural equation modeling in strategic management research: a review of past practices and recommendations for future applications. Long Range Planning, 45(5–6): 320-340. DOI: https://doi.org/10.1016/j.lr2012.09.008

Hays, S. et al. 2013. Social media as a destination marketing tool: its use by national tourism organisations. Current Issues in Tourism, 16(3): 211-239. DOI: https://doi.org/10.1080/13683500.2012.662215

Hulland, J. 1999. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strategic Management Journal, 20(2): 195-204. DOI: https://doi.org/10.1002/(SICI)1097-0266(199902)20:2<195:: AID-SMJ13>3.0.CO;2-7

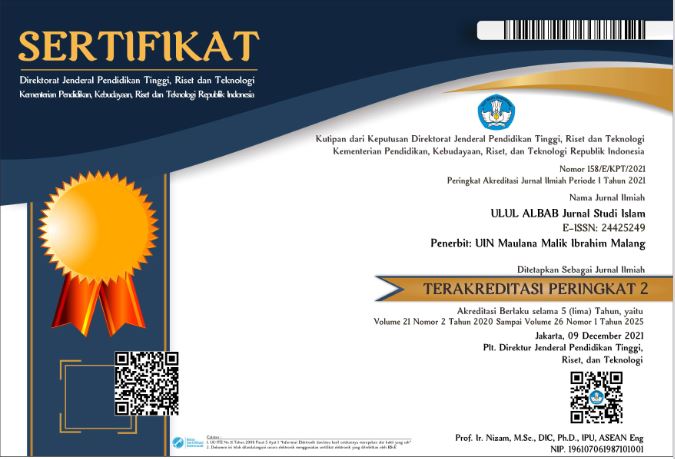

Ipandang, I., & Djaoe, A. N. M. 2022. Social Intermediation of Sharia Banking from the Islamic Law Perspective: A Case Study at Bank Negara Indonesia (BNI) Syari’ah. Ulul Albab: Jurnal Studi Islam, 23(1): 70-93. DOI: https://doi.org/10.18860/ua.v23i1.15491

Ives, B. et al. 1983. The measurement of user information satisfaction. Communications of the ACM, 26(10): 785-793. DOI: https://doi.org/10.1145/358413.358430

Jensen, M. C., & Meckling, W. H. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4): 305-360.

Kock, N. 2011. Using WarpPLS in e-collaboration studies: Mediating effects, control and second order variables, and algorithm choices. International Journal of E-Collaboration (IJeC), 7(3): 1-13. DOI: https://doi.org/10.4018/jec.2011070101

Liao, W.-J., Lin, Y.-E., Li, X.-Z., & Chih, H.-H. 2022. The effects of behavioral foundations and business strategy on corporate dividend policy. Frontiers in Psychology, 13. DOI: https://doi.org/10.3389/fpsyg.2022.849238

Martiana, A. et al. 2022. Pro-Poor Capital Assistance: A Strategic Analysis of Baitul Mâl wa al-Tamwil (BMT) Microfinance. Al-Uqud : Journal of Islamic Economics, 6(28): 1-16. DOI: https://doi.org/10.26740/al-uqud.v6n1.p1-16

Rofiqo, A. et al. 2022. Factors that Influence of Behavior to Contribution in Islamic Peer-to-Peer Lending with PLS-SEM Approach: Empirical Studies in Indonesia. Journal of Islamic Economics Lariba, 8(1):76. DOI: https://doi.org/10.20885/jielariba.vol8.iss1.art5

Shith, M. S. S. M. et al. 2021. Using the Theory of Planned Behavior and Religion to Assess Customers Behavioral Intention to Adopt Islamic Banking Services in Malaysia. Jurnal Islam dan Masyarakat Kontemporari, 22(2): 36-45. DOI: https://doi.org/10.37231/jimk.2021.22.2.575

Sholihin, M., & Ratmono, D. 2013. Analisis Sem-Pls Dengan Warppls 3.0 Untuk Hubungan Nonlinier Dalam Penelitian Sosial Dan Bisnis. CV Andi Offset: Yogyakarta.

Sufyati, H. 2021. Implementation of Corporate Social Responsibility in Islamic Banking in Indonesia. Advances in Social Science, Education and Humanities Research, 560: 525-530. DOI: https://doi.org/10.2991/assehr.k.210615.098

Supriatna, S. et al. 2020. Mudharabah Scheme Within the Islamic Banking: Profit Sharing and Associated Problems in It. Kodifikasia: Jurnal Penelitian Islam, 14(2), 235-262. DOI: https://doi.org/10.21154/kodifikasia.v14i2.2121

Thoradeniya, Prabanga et al. 2015. Sustainability reporting and the theory of planned behaviour. Accounting, Auditing & Accountability Journal, 28(7): 1099-1137. DOI: https://doi.org/10.1108/AAAJ-08-2013-1449

Warsame, M. H., & Ireri, E. M. 2016. Does the Theory of Planned Behaviour (TPB) Matter in Sukuk Investment Decisions? Journal of Behavioral and Experimental Finance, 12(C): 93-100. DOI: https://doi.org/10.1016/j.jbef.2016.10.002

DOI: https://doi.org/10.18860/ua.v23i2.17038

Refbacks

- There are currently no refbacks.

Tools:

Indexed By:

All publication by Ulul Albab: Jurnal Studi Islam are licensed under a Creative Commons Attribution-ShareAlike (CC BY-SA)

Ulul Albab: Jurnal Studi Islam, P-ISSN : 1858-4349, E-ISSN : 2442-5249